tv Nightly Business Report PBS December 24, 2012 4:30pm-5:00pm PST

4:31 pm

captioning sponsored by wpbt >> this is n.b.r. >> susie: good evening, everyone. i'm susie gharib. tom will be along a little later in the program. last-minute christmas sppers filled the stores today, but will it be enough to push retailers into the green this holiday season? the clock is ticking to the fiscal cliff deadline, but with those talks on hold, so is the santa claus rally on wall street. and they're a rare breed in corporate america. we look at why so few c.e.o.'s are women. that and more, tonight on nbr. >> susie: not a very merry day of trading on wall street today. it was a holiday shortened session, and the investors and traders working on this half- day were playing it safe, especially with the fiscal cliff talks on holiday break as well. when the closing bell rang at 1:00 eastern time, the dow was

4:32 pm

down 51 points, the nasdaq lost eight, and the s&p was off 3 points. so while wall street worked half a day, washington was on vacation. lawmakers are increasingly pessimistic about a big agreement-- or any agreement-- being reached before the year ends. darren gersh has the latest. >> reporter: 'twas the night before christmas, and all through the house, nothing much was going on. it was the same story in the senate. washington's cliff talks still remain deadlocked. congress will return on thursday, and it's still possible a few days of holiday cheer and constituent outrage may push republicans and democrats to craft a last-minute agreement to avoid the worst of the fiscal cliff. if we do go over the cliff, the i.r.s. has warned most taxpayers may not be able to file their returns until late march. that would mean long delays for many tax refunds. and economists warn the economic effects will be felt quickly if $600 billion in automatic tax

4:33 pm

increases and spending cuts begin to take effect next year. at this rate, it looks like lawmakers will celebrate new year's eve at work-- if not resolving the fiscal cliff, at least trying to avoid the blame. darren gersh, nbr, washington. >> susie: going over the fiscal cliff will not only have an impact on the national level, it will also hit states and eventually cities. if lawmakers fail to reach a deal before january 1, the cliff's across the board spending cuts and tax increases will impact how much money states get from the federal government. ruben ramirez reports from washington. >> reporter: we all know the numbers. failing to reach a deal by january 1 will result in $109 billion in automatic cuts to federal spending. and while that's a big number, what matters most to states and municipalities is the small print, detailing just where those cuts will happen. and standard & poors' gabe pettek says those details could still be months away. >> even if the policymakers in

4:34 pm

washington, d.c., resolve the immediate issue before january 1 or shortly thereafter, we think there are going to be several details related to the administration of tax policy and the way the federal government spends money that will have an important effect on state budgets. >> reporter: the pew center on the states reports around 18% of federal grants to states would be subject to sequestration's spending cuts. that works out to about $7.5 billion the states could ultimately lose. >> the real worry right now for states is that as many states start there legislative sessions next month is just the uncertainty from capitol hill. >> reporter: the uncertainty will make it difficult to put together state budgets, which need to be in place before the new fiscal year begins next summer. two big unknowns: the future of medicaid and municipal bonds. medicaid and the children's health insurance program, or chip, which under current law are exempt from the sequester,

4:35 pm

could be one area where lawmakers look to make cuts. in 2010, more than 40%-- or about $278 billion states received in overall funding-- went to these two programs. >> looking at past proposals, there is a good chance that something like medicaid would be cut, and that would obviously have direct impact on state budgets. but what it would entail is still unknown. >> reporter: also on the table for lawmakers to consider: municipal bonds. they've traditionally been tax- exempt. if that changes, they could become less attractive as an investment vehicle, and end up raising borrowing costs for states and municipalities. >> it would effectively increase the cost of issuing debt to state and local governments, and it's a real consideration at a time when states and local governments are still in repair mode. >> reporter: while some states have built up rainy day funds,

4:36 pm

credit rating analysts at s&p say for the first time since the start of the financial crisis, the health of the overall u.s. economy has become the biggest concern for state economies. with state budgets already constrained, deeper cuts from the federal government could leave them in a pickle. after all, unlike the federal vernnt, statesre ruir to balance their budgets every year. ruben ramirez, nbr, washington. >> susie: still ahead, there's more to holiday spending than electronics and apparel. we'll look at one holay decorating business. >> susie: 'tis the season for procrastinators. 17 million americans were expected to hit the malls today. and the good news for merchants: many of them were simply crossing off names on their list, not bargain shopping. as erika miller reports, retailers hope they'll turn a ho-hum christmas into a merry one. >> reporter: the success of the holiday season for retailers

4:37 pm

depends on procrastinators, and also on families like the greers picking up a few extra gifts before the big day. >> we are looking for stationery, for frames. >> reporter: and that also means more gift wrap. >> we want gifts that you wonder if you really want to open them. that's what we want, those that catch your eye-- the beautiful bows, the wired ribbon. it's all so much a part of it. >> reporter: statistically, men are far more likely to leave their holiday shopping till last-minute. >> we do notice a lot of men coming into the store. i would say the difference between the men and the women-- the men come in, and they want us to take the lead and show us how it's done. >> reporter: not surprisingly, most stores are pulling out all the stops today to lure shoppers, offering deep discounts. >> the weather hasn't gotten cold in the majority of the country, through the midwest and the northeast. so cold weather categories like sweaters, outerwear are being promoted 50%, 60% off. >> reporter: the holiday season shopping season started out with a bang, but since then, many shoppers have been waiting on

4:38 pm

the sidelines. although the economy is improving, many consumers still feel uneasy about their finances. >> some are worried about the job market. others fear the u.s. will fall off the fiscal cliff, leading to less disposable income next year. so this year, it's taking more than a good deal for retailers to make a sale. >> a lot of people talk about value. the thing they don't talk about is affordability. so while you may think that sweater at barney's or nordstrom's is a value, at whatever price it is, you can't afford it. and affordability is something that is resonating a lot more than value. >> reporter: so the season is not expected to be a sparkling one for merchants, with gains in the low to mid single digits. discounters are expected to do better than luxury stores. but don't forget, it is the holidays, and christmas just wouldn't be the same without a few splurges.

4:39 pm

>> we kind of get in the spirit of shopping. we go, okay, okay one more, oh they'd really like that, he'd really like that-- and a little for myself, too. >> reporter: erika miller, nbr, new york. >> susie: don't let the fiscal cliff scare you away from buying stocks. that's the advice to investors from andy cross, the chief investment officer at the motley fool. tom hudson recently spoke with him, and began by asking if the s&p 500 will be higher or lower this time next year. >> that's a tough question. i'm not in the job of picking the stocks over, you know,

4:40 pm

three, six, nine, even 12 months is tough for me. here's what i do think. i do think we'll get some resolution to the fiscal cliff, whether it's right now or whether it's soon after the new year, i think we will see so kin of resolution. that will be good for markets, good for business, good for investors. so i'm going into 2013 wanting to be long some really good high quality companies that i know can accrue returns for investors over time. and i don't want to think with the next few months. >> tom: let's focus on the next year ahead. what about volatility, do you think you'll need an iron stomach to be a stock investor? >> i think investing in stocks, in equities comes volatility. we're not bying bonds here, we're not sticking the cash in o mattress in our beds. so i think with investing if you're going to be an investor you have to be able to handle the ups and downs that come with investing in stocks. now, here's what i think most investors should do out there, which is diversify. i really want you thinking about owning dozens of stocks

4:41 pm

to help mitigate some of that volatility you will see as investing in stocks. >> tom: you've brought two along for the next year, clb, core laboratories, a netherlands based company, no in the medical business but in the energy business. explain why you like this multinational. >> yes, tom, sound like it belongs in the medical business, but actually no it's really a science business. core labs, about a $5 billion company and they specialize in helping oil companies find more oil and more gas that benefits all around the world. so they have scientists who actually take samples of rock and water, analyze that and try to help oil companies find more oil that may be hidden or tucked away so we can abscess more oil, which good for all o us. >> t: we're talking about an energy boon in the united states, energy prices, that's helped keep a cap on energy prices here. what kind of holding time

4:42 pm

frame do you anticipate to make some money? >> as we've seen this year, one reason why core labs is attractive from a valuation perfect suspective we've seen the stock soften this year as some of the rig counts have softened as well because of the i prices of natural gas have really fallen. and i do think this will reverse sometime over the next few years and we'll see more rigs be put to use, an that's good for core labs, but to do that you really need to take that three-year time horizon. >> tom: luk, often called a mini berkshire hathaway, beef packing, commercial mortgage, copper, energy, even wine. what makes you like this one? is there a conglomerate discount? is the stock price held down because it's so diversified? >> it's one of the reasons i think it's attractive is they have all these different assets, and the guys who have run it since the late 70s have john efforted up to 20% return year. they have put their brain

4:43 pm

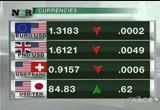

power to work, they make really smart investments, they actually own the air space over union station here in washington d.c. that they'll put to use somehow, some way. so investors who buy behind lukadia, luk, you have to put some faith into the investors, these guys who run it will put the cast to work in smart ways and history is on its side here. >> tom: you're buying the investment team as much as those individual companies. do you own any yourself in these two companies, andy? >> i do not own core labs or lukadia. >> tom: andy cross with the motley fool. >> susie: wall street wisdom says if santa claus comes to broadway and wall in the last five trading days of the year, stocks rise in the new year. but no signs of santa today, with mostly red and little green on this day before christmas. big board volume fell to 285 million shares. nasdaq volume weighed in at 616 million. it was the lightest volume so far this year. two s&p sector standouts were materials, which gained half a percent, and energy, which lost

4:44 pm

nearly 1%. some news from the oil patch. chevron is buying a stake in two canadian shale gas fields as well as a facility to ship the gas to asia. chevron's canadian unit is buying out encana and e.o.g. resources and will become an equal partner with apache. terms of the deal were not disclosed. shares of chevron ended down less than 1%. encana was down just over 2%. e.o.g. resources was down fractionally. federal agencies are looking into allegations that regions financial bank improperly classified loans that went bad during the financial crisis. the government inquiries include subpoenas from the s.e.c. and other bank officials that are part of a civil lawsuit against the bank. shares of regions financial fell nearly 2% to just below $7 a share. as erika mentioned earlier, consumers were out in force trying to squeeze in their last few hours of christmas shopping. one of those retailers hoping to get a boost from shoppers

4:45 pm

looking for a bargain is j.c. penney. analysts at oppenheimer say the retailer's aggressive price prmotions will drive traffic into the stores and boost the mpany's turnaround eorts. over the past year, shares of j.c. penney have struggled. they are down 43% this year. today they rose more than 1% to just under $20 a share. a few buyers of the stock today family, closing under just $12 a share. over the past year, shares down 50%. now shares of online shares of online travel company trip advisor got a boost on the back of some positive comments. analysts at needham say they are optimistic about the company's long-term growth prospects. they expect trip advisor to exceed profit forecasts for the first half of 2013. shares of trip advisor were up more than half a percent to $42.

4:46 pm

herbalife also got a pop today. the vitamin maker says it expects to buy back more shares than it had previously announced. the shares had been down for the last eight sessions, but today it rose 4.%. and if you're driving this holiday season, get ready to pay more at the pump. but prices are set to go up after falling more than ten cents over the past two weeks. according to the lundberg survey, gasoline prices on average around the country were $3.25 a gallon. that's the lowest since mid- december of last year. and finally turning, to our most actively traded e.t.f.'s, here you can see most settled modestly lower to unchanged. and that's tonight's market focus.

4:47 pm

>> susie: our word on the street tonight: dividends. investors who shy away from dividend-paying stocks next year because of higher taxes will miss some of the best income sources of 2013. so says david peltier, portfolio manager at thestreet.com. you know, dave, most people do live dividend paying stocks, but they're very worried about tim my indications of higher taxs all around, whether it's on capital gains or income taxes, so they are staying a way from dividend paying stocks. make a case of why they should buyçó them. there are a lot of choices,

4:48 pm

4:49 pm

4:50 pm

any disclosures, david, do you own these stocks? all right, thanks so much, have a great holiday. we'll see you soon next time. david pelletier, portfolio manager at the streets.com. slow rog in 2012 slow progress in 2012 of women moving into top positions, in boardrooms and the executive suite. new research from catalyst shows 16.6% of fortune 500 company directors are women, up from 16.1% last year. 14.3% of company executive officers are women, up from 14.1% a year ago. as for c.e.o.'s, the number of women on the fortune 500 will hit a record 21 on january 1, when phebe novakovic takes charge at general dynamics. recently i talked with catalyst president ilene lang and asked her what's holding women back. >> the reason women don't get to the top jobs is because in their careers they are not

4:51 pm

tapped for the assignments that would really give them that breakthrough experience where they have the experience and the visibility that they have done what we call top jobs. women and men get leadership training, they get sent to classes, they get coaching, they get sponsorship and mentorship. but at the end of the day, the jobs that the men get have three times the budget, twice the staff, much more international, even among women who say they're ready for an international assignment they want to have one, much higher percentage of the men who say they're available are tapped for them than women. >> susie: so what's it going to take to get more women to become c.e.o.s? right now there are only 20 women who are c.e.o.s of fortune 500 companies. when i first started out as a business journalist there was only one, catherine graham of the washington post. >> so if there's a magic bullet, the magic bullet is something we call sponsorship. sponsorship is like mentorship,

4:52 pm

but it also includes actually putting a person forward, endorsing her and saying she can do this job. and we are seeing progress. we are seeing that the minute a woman is endorsed by a powerful man, suddenly she's visible. suddenly she's board qualified, suddenly she's ready. and it busts that myth that says that there aren't enough women. this is not a supply problem. but it is a conventional thinking problem. >> susie: what is the impact of having women in board rooms and in the executive, i've noticed that the ber views i've done, women c.e.o.s like the one from you duponth and xerox, they have a different leadership style, but the does it make a dumpbs? >> companies with women on their boards have a higher financial performance than those with fewer. the research suggests that it's beuse when you add diversity, you get more points of view, more background, more

4:53 pm

critical thinking, more opportunities examined, more solutions considered, and you get a better result. there also is evidence that there's more innovation because the more you mix different points of view, it's kind of cross functional, points of view and backgrounds, you get breaks of thinking. >> susie: sounds like you are seeing some progress, and one of the trends that you're expecting for 2013? >> i think today every time there's an opening and an opportunity, people are expecting to see women as part of the mix. and i think that is a huge difference. so when we're talking about appointing a new senator, or electing somebody, or appointing a member to a board, people are saying why not women, because they're used to seeing more women in more leadership positions, and that has a real role model effect, but it also changes people's perspective about who can be a

4:54 pm

really strong contributor. >> susan: so what's your advice to young ambitious womenustcoming out of college or those who have an mba or law degree and want to ride to the top? >> i think they should build their careers in places where they can see that there is support for women and where women have been successful, and that could be a large company that has women at the top. it could be an industry where women are really flourishing. but there's no denying we're going to see a lot of women in a lot of places, and they're going to be very successful, and that's fantastic. >> susie: our partners at stanford >> susie: our partners at stanford university have new research on how women in business tend to turn traits like confidence and assertiveness, on and off, to fit the situation on their climb up the corporate ladder. you can learn more on the web. just head to nbr.com, and look for the nbr-u tab. tomorrow on nbr, the markets are closed for the christmas holiday, so we bring you a christmas treat, "made in america."

4:55 pm

it's a special edition looking at unique companies, big and small, building jobs and community. when it comes to christmas decorations, americans on average spend $50 decking the halls. allison worrell takes us on the job with a hired hand helping roll out the holiday cheer. >> reporter: snowy scenes like this one are what many americans think about when it comes to a picturesque holiday season. but clear skies, sandy beaches, and highs in the 70's? not so much. and when you think about holiday decorating, florida probably isn't the first place that comes to mind either, but the holiday decor business is doing quite well in the sunshine state. >> the clients we're calling on are the rich and famous. they're professional athletes, they're industry leaders, and we're in the business of complete sales, service and installation for these types of people. >> reporter: david shindler has been in the christmas business for more than 20 years. he's a franchisee at holiday decorating firm christmas decor.

4:56 pm

>> we'll custom decorate well over a couple hundred homes this year, and part of that is complete custom interiors and custom exteriors. >> reporter: if you want your house to look like this, you'll have to have a lot of this. prices start around $1,500, average $3,000, and can run as much as $20,000 for some of their bigger commercial clients. shindler describes this waterfront fort lauderdale home as one of the more modest residences he's decorating, and he says his team of seasonal workers give customers a look they couldn't do on their own. >> we're using very specialized product, we're using very specialized installation techniques. and the overall outcome is astronomically more impressive than even your most talented homeowner could do. >> reporter: so what does his home look like during the holidays? >> it's not the best house we do much, to my wife's dismay. she does not understand why that is, but sort of the old adage of the shoemaker's children always go barefoot. >> reporter: allison worrell, nbr, fort lauderdale, florida.

4:57 pm

4:58 pm

>> susie: not a very merry day of trading on wall street today. it was a holiday shortened session, and investors played it safe. especially with the fiscal cliff talks on holiday break as well. when the closing bell rang at 1:00 eastern time, the dow was down 51 points, the nasdaq lost eight, and the s&p was off three points. 't the season for proastitor 17 million americans were expected to hit the malls today. the good news for merchants: many of them were simply crossing off names on their list, not bargain shopping. tomorrow, with the markets closed for christmas, we bring you "made in america," an nbr special looking at unique u.s. companies, big and small, building jobs and community. for more financial news, tune in to nbr, weeknights on this public television station.

130 Views

IN COLLECTIONS

KRCB (PBS) Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11